60% of Canadians Face High Credit Card Debt – Here’s How to Take Control

With the average Canadian carrying $5,000 in credit card debt and interest rates starting at 22.99%, managing finances has become a significant challenge. Consolidating your debt is a smart solution to reduce interest costs, lower monthly payments, and regain control of your financial future. Take the first step toward maximizing your spending power and achieving financial peace of mind today.

One Simple Payment

Lower Interest

Cut Down Monthly Bills

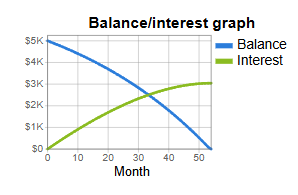

Average Canadian’s Credit Card Debt

Our consolidation plan is designed to help over half of Canadians who are struggling with high credit card interest rates, often starting at 22.9%. The graph above highlights the impact of these high rates, showing how many individuals end up paying more in interest than the original amount they owe. The example shows paying an extra 50% on top of the minimum payment. With our plan, you can reduce both your monthly payments and interest rates—often by more than half—allowing you to pay off your debt faster and more efficiently. This approach helps you keep more of your money while reducing the total cost of your debt over time.

Our Consolidation Plan

Our consolidation plan helps you streamline your debt repayment by combining multiple credit card balances into one manageable payment. With this plan, you’ll benefit from significantly lower monthly payments and a reduction in interest rates—often by more than half. Over time, this means you’ll pay less interest and eliminate your debt more quickly, putting you on a clear path to financial freedom.

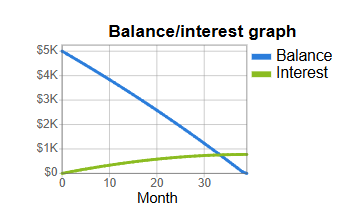

The Difference and Savings

The graph above illustrates the difference between our consolidation plan and the average credit card debt repayment over time. The red line represents typical credit card repayment, while the blue line demonstrates the projected repayment under our consolidation plan, using the same amount of monthly funds. As shown, the gap between the two increases as the amount of credit card debt grows, highlighting the significant advantages of our consolidation strategy.

How High Credit Card Interest Adds Up—and How We Help Canadians Save

Credit Card Debt Consolidation

Credit card debt consolidation is a powerful solution for Canadians looking to manage high-interest debt effectively. By combining multiple credit card balances into one low-interest payment, you can simplify your finances, reduce monthly payments, and save on interest costs. Whether you’re struggling with overdue credit card bills or looking for a way to pay off debt faster, debt consolidation offers a clear path to financial freedom. Explore how credit card debt consolidation can help you take control of your finances, improve your credit score, and achieve lasting peace of mind.

Lower Interest Rates

Struggling with high credit card interest rates? The average credit card rate in Canada hovers around 22.9%, making it hard to pay down your debt. With our credit card debt consolidation program, you can lower your interest rate to as little as 8.99%, saving you thousands of dollars in interest over time. By consolidating your debt into one manageable payment with a reduced interest rate, you’ll pay off your balance faster and keep more money in your pocket. Don’t let high credit card interest rates hold you back—discover how consolidating your debt can help you regain control and achieve financial freedom.

Smaller Payments

Are high monthly credit card payments keeping you trapped in debt? With our credit card debt consolidation program, Canadians can combine multiple credit card balances into one affordable monthly payment. On average, our customers save $3,000 per year, cutting costs and eliminating unnecessary fees. Lowering your payments with debt consolidation makes it easier to manage your finances, pay off credit card debt faster, and regain control of your budget. Don’t let overwhelming credit card payments hold you back—explore how debt consolidation can simplify your finances and put you on the path to financial freedom today!